Teneo works with the CEOs and leaders of the world’s leading companies and institutions, providing strategic counsel across their full range of key objectives and issues . With over 1,300 professionals across 38 offices, we combine an unparalleled international network with local expertise in the areas of strategy and communications, talent advisory and risk advisory. Additionally, Teneo is able to tap into a wide network of Senior Advisers for support throughout client engagements.

Teneo has extensive experience in the global transportation industry, including rail, bus, road, and in particular, aviation. Over the past decade, Teneo has worked directly with the world’s largest airlines and airports, their lenders, and central government to support strategic and commercial decisions across a range of topics. Since the Covid-19 outbreak in Q1 of 2020, Teneo have taken a leading role across multiple industries in forecasting consumer and passenger demand for products, services and transportation in the wake of the political, economic, and behavioural changes brought about by the pandemic.

A key area of this work has been in the forecasting of aviation demand recovery at a highly granular level across a range of scenarios.

To facilitate this work, we have developed a Central Forecasting Model, which contains highly granular aviation forecasts for every major country and airline in the world, taking into account a range of factors and running a range of scenarios. This paper marks the first quarterly industry update on forecast aviation demand. We present a UK-centric and US-centric forecast for these purposes, but regional (and airline-specific) forecasts are available upon request.

Teneo’s broader work in the transportation and infrastructure sector includes commercial and financial advisory to rail and bus-owning groups; demand analysis in rail, bus, and road; direct work with central government on the future of transportation post-Covid; and transaction support in the broader transport and infrastructure space.

Forecasting Methodology

Our Central Forecasting Model is a granular bottom-up approach to aviation demand forecasting, which can be applied to any country, region, or airline.

Using 2019 passenger volumes and revenue as the base, historic demand is segmented by factors such as country, airline, airport and purpose of travel to provide a segmented view of pre-pandemic demand. Various suppression layers are then applied to each segment in turn to account for the level of demand suppression expected in each segment for factors such as travel restrictions, wider border frictions, economic damage, and consumer fear and behaviour.

Over 100 different public and proprietary data sources – including economic forecasts, consumer surveys, and people movement data – are included in the model to build a granular as possible view of suppression across each segment.

Through the combination of these suppression factors and the aggregation of the various segments, we are able to forecast demand at various levels and various splits, including by airline, airport, country, region, or travel purpose.

After a central forecast has been established, key assumptions can be flexed to account for and model a range of scenarios including further regional Covid-19 variants, differential levels of economic recovery and varying views of key factors such as business travel recovery.

Insights: UK-Centric

UK-centric demand refers to flights to and from the UK to the regions shown below.

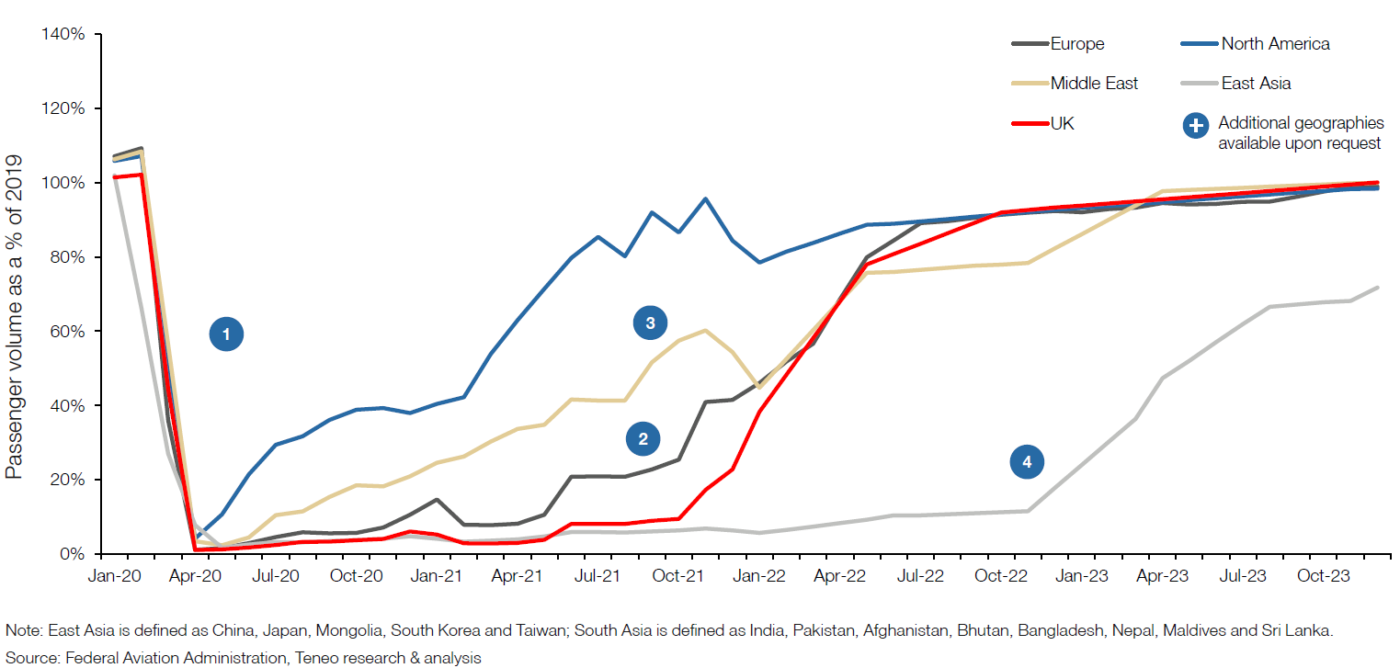

UK-Centric Travel Demand By Region, 2022-2023

Key Takeaways

- Overall travel demand fell by over 99% as a result of the initial response of the world to Covid-19 in April 2020.

- Most countries started lifting restrictions in Q3 2020, which led to the first wave of recovery, albeit this was quickly interrupted by the emergence of the Delta variant.

- The second wave of recovery started in Q2 2021 when many countries reached sufficient vaccination levels to ease entry rules for vaccinated travellers.

- Passenger recovery rates throughout the summer of 2021 were strong for short-haul and Middle East travel, largely due to a lack of entry restrictions during this period.

- North American recovery lags behind other regions as the US only opened borders in early November for vaccinated travellers.

- South Asia exhibited material levels of latent demand due to high volumes of VFR travel to India in particular

- Swift responses to the Omicron variant by countries in Europe and the Middle East caused modest declines in passenger revenue in November-December 2021.

- Both regions are forecast to return to growth in Q1 2022 after a short-term shock caused by Omicron, noting the speed with which most countries have reversed restrictions.

- Europe is forecasted to recover to c.80% of the 2019 level in July 2022 as it is predicted to largely re-open for UK-centric tourism later this year.

- Despite the later reopening, North American demand is forecast to continue to recover.

- East Asia is the only region that is not forecast to reach 80% of the pre-pandemic revenue by December 2023. Its recovery lags behind due to more severe government restrictions and travel frictions such as China’s zero Covid-19 policy.

UK-Centric Travel Demand by Purpose of Travel, 2022-2023

Key Takeaways

- The impact of the Covid-19 pandemic on business travel has been more significant.

- Most countries started lifting those restrictions in Q3 2020, which led to the first wave of recovery. This was quickly interrupted by the emergence of the Delta variant.

- The second wave of recovery started in Q2 2021 when many countries reached sufficient

vaccination levels to ease entry rules for vaccinated travellers. Most companies quickly introduced flexible work-from-home policies, which caused a more severe decrease in business travel. - Business travel has a slower pace of recovery ending up at c.87% of the 2019 figure in December 2023 as companies are forecasted to gradually increase budgets for corporate travel.

- Leisure travel appears to be more sensitive to government and travel restrictions, with January 2022 suppressed to c.42% due to Omicron-related frictions.

- Leisure travel is forecast to recover considerably faster than business and is predicted to reach c.97% of the pre-pandemic levels in December 2023.

- Acceleration is forecast in Q1 2022 as countries are expected to lift Omicron-related travel restrictions.

- Growth will continue until December 2023 as most countries are expected to broadly remain open for tourism and not bring back any travel restrictions.

Scenario-Based Modelling for the UK Market

Our Central Forecasting model includes a base case scenario and two more pessimistic scenarios to consider a more prolonged Covid-19 related impact on revenue suppression.

Scenarios for UK-Centric Demand

Scenario 1 – Slower business travel

- This scenario predicts a slower business travel recovery, with business travel never fully recovering to pre-pandemic levels.

- Due to improvements in remote working technology and structural changes in business/employee behaviour, there is a risk that certain aspects of business travel will never resume.

- A Bloomberg survey of companies across Europe, North America and Asia found that 84% of companies plan to spend less on business travel post-pandemic.

- As a result, we have modeled a slower business recovery that is capped at 65% of pre-pandemic levels.

Scenario 2 – New variant

- This scenario predicts that another Delta-like variant will emerge towards the end of 2022 against which current vaccines only offer limited protection.

- “This pandemic is nowhere near over and with the incredible growth of Omicron globally, new variants are likely to emerge.” - Tedros Adhanom Ghebreysus WHO Director-General

- This scenario, which seems less likely to occur but is still a possibility, would result in borders closing again as well as customer fear resurfacing.

- Air travel is expected to drop more quickly after the new variant hits but is likely to recover quicker than it did after the Delta variant due to most countries now having the right infrastructure in place to roll out new vaccines quickly.

Insights: US-Centric

US-centric demand refers to flights to and from the US to the regions shown below.

US-Centric Travel Demand by Region, 2022-2023

Key Takeaways

- The overall travel demand fell by over 99% as a result of the initial response of the world to Covid-19 in April 2020.

- Due to less stringent foreign restrictions on US travellers (compared to the UK) and a strong domestic aviation market, the US broadly recovered more quickly than the UK across all regions.

- The UK and Europe have followed similar bi-directional recovery trends, but this has been led by the rate at which the US has opened its borders to the rest of the world. The critical date of reopening was in November 2021 when US – UK/EU travel resumed for vaccinated travellers.

- UK – US travel is forecast to reach the prepandemic level in December 2023, albeit with a greater proportion of leisure travel than previously.

- Similarly, US – Europe is predicted to recover to c.96% by the end of 2023.

- Middle East travel was affected by the emergence of the Omicron variant from November 2021-January 2022 but is projected to return to growth in March 2022.

- Middle Eastern countries are expected to largely remain open for tourism and not introduce new any travel restrictions for vaccinated passengers.

- East Asia is the slowest region to recover as countries of this region are very conservative in re-opening for international tourism.

- The recovery is forecast to accelerate in Q1 2023 as some countries are projected to start lifting travel restrictions.

Insights: Initial View of the Russia-Ukraine Conflict on Passenger Demand

The conflict in Ukraine has a number of emerging implications for air travel demand.

Key Takeaways

- Russia has closed its borders to western airlines and recalled its flag carrier, effectively closing the market to commercial aviation. Ukraine, as an active war zone, is also inaccessible for commercial flights.

- This will result in a direct loss of revenue for operations in both markets for the duration of the immediate conflict.

- No-fly zones over Russia, Ukraine and neighbouring territories will require re-routing.

- Without access to Russian airspace, many European airlines will have to take longer routes to reach APAC markets. Increasing costs and flight times are likely to have a negative impact on demand.

- Airlines which have historically leveraged their proximity to Russia may need to pivot their business entirely.

- We expect that neighbouring countries will see increased fear levels, driving lower demand, particularly among leisure travellers.

- The conflict is expected to substantially reduce leisure to neighbouring countries, such as Poland, Romania and Hungary.

- One airline reported overall bookings down 20% week-on-week following the invasion of Ukraine, staying down by 9% even after a week, providing a first look at the impact of fear.

- Government sanctions against and private divestment from Russia is already expected to yield real macroeconomic impacts.

- Oil prices have soared as Russian energy supply fears have intensified, leaving airlines exposed to extremely volatile fuel prices.

- There is risk of significant impacts on global GDP growth and intensifying existing inflation / cost of living concerns.

Appendix

Average Yearly Model Outputs (UK-Centric)

Average Yearly Model Outputs (US-Centric)

Business and Leisure Recovery (UK-Centric)