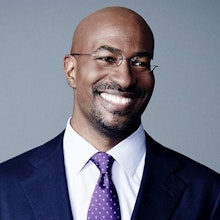

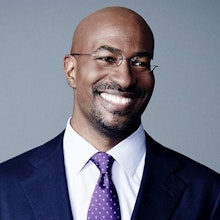

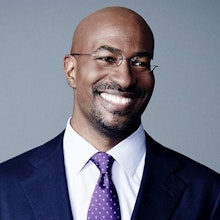

Gavin Park is a Senior Managing Director with Teneo and leads the Financial Advisory team in Scotland.

Gavin has 15+ years restructuring experience and works across a range of sectors, covering both corporate and creditor advisory in addition to formal insolvency work. Prior to Teneo’s acquisition of Deloitte UK’s restructuring team, Gavin led Deloitte’s Scottish RS team. Gavin’s experience includes financial restructurings, accelerated M&A processes, advisory remits for lenders, shareholders and corporate clients, as well as complex insolvency assignments. He has an MBA and is JIEB qualified as well as a Chartered Accountant with ICAS.

Selected Project Experience:

- Project Willow – Lead financial advisor.

- Project Wonder – Advisor to the board of a sponsor backed, profitable construction/infrastructure Project Willow (Advisory, Food manufacturing) – Advisor to company on covenant breaches and debt maturities.

- Project Wonder (Advisory, Construction) – Advisor to the board on stakeholder negotiations and MBO/refinancing.

- Project Volantes (Advisory, Aviation) – Advisor to the lenders following borrower liquidity challenges.

- Project Morello (Advisory, Food manufacturing) – Advisor to company and lender on financial performance and recapitalisation options.

- Project Gate (Advisory, CPG) – Advisor to lending group following covenant breaches.

- Bifab (Administration, Industrial) – Joint Administrator. Successful sale of business achieved.

- Project Lavender (Advisory, Industrial) – Advisor to provider of financial guarantees.

Project Bear (Advisory, TMT) – Advisor to lenders on business recapitalisation. - Goals (Administration, Leisure) – Joint Administrator, successful sale of business achieved.

- Project Spinney (Advisory, Construction) – Advisor to the company.

- Project Grange (Advisory, Real Estate) – Advisor to the company on restructuring options.

Related Service Areas