Macroeconomic Outlook

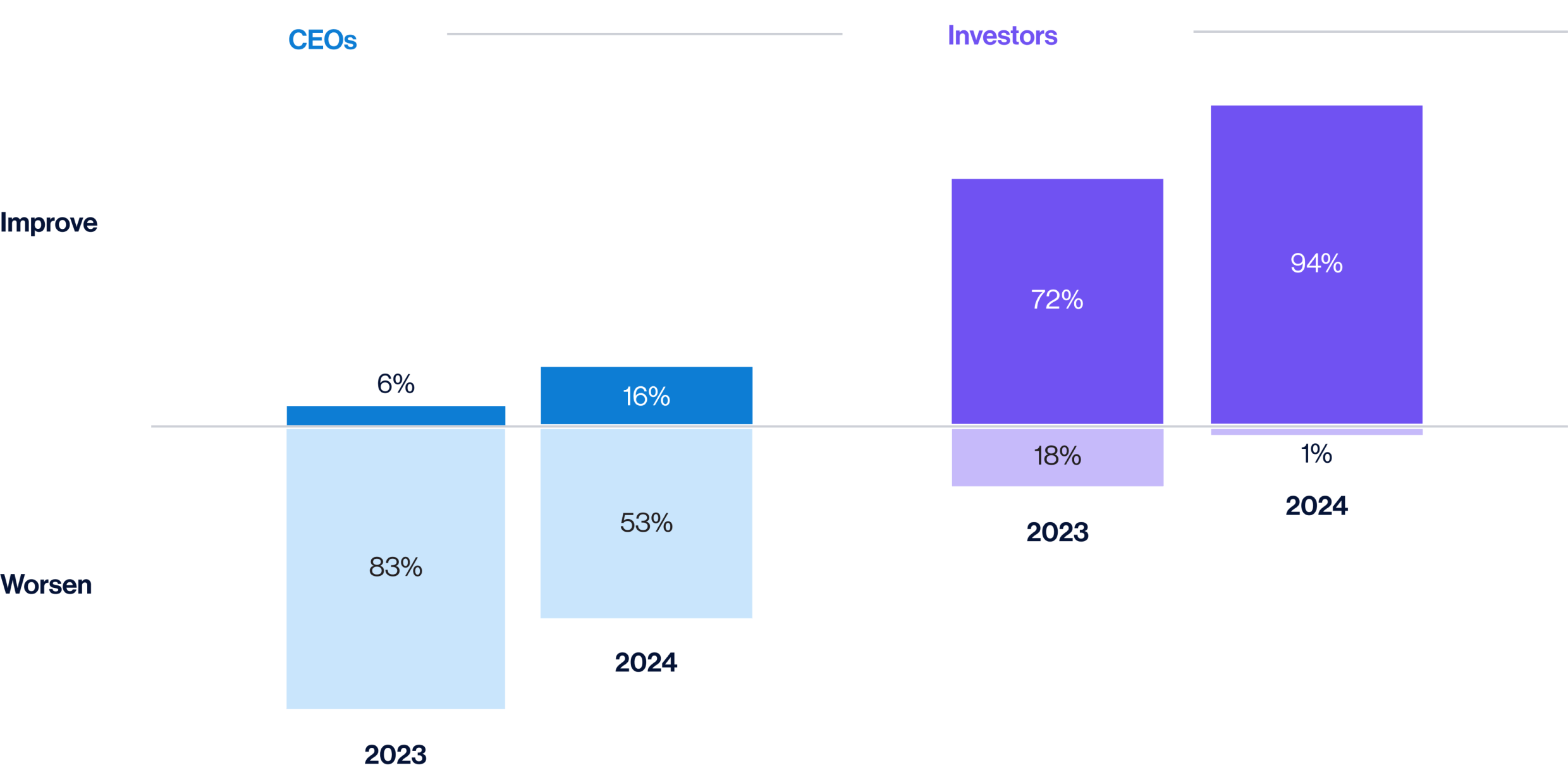

The market has become highly bullish on macroeconomic conditions for the first half of 2024, with 94% of investors expecting an improvement in the macroeconomic outlook (up from 72% last year). This view is not shared by CEOs, who remain pessimistic, with 53% expecting macroeconomic conditions to worsen (compared to 83% last year).

It remains to be seen how this disconnect plays out in 2024. However, last year’s investor optimism has been validated – with the S&P 500 up 20% year to date, the DAX index up 17% and the Nikkei 225 up 28%, while the FTSE lags at flat year to date.

Question: Do you expect the global economy to improve or worsen over the first six months of 2024?

By an overwhelming margin, investors (88%) expect movements in the rate of inflation to have a positive impact on businesses during the first six months of 2024. Yet CEO responses are markedly uneven, depending upon industry and region.

Retail, energy & materials and transportation leaders are bracing for the most serious impact, while those representing media & entertainment, manufacturing and financial & professional services appear poised to benefit.

Meanwhile, CEOs from Latin America (83% positive) and Europe (64% negative) find themselves on opposite ends of the spectrum.

Question: How much of an impact do you expect inflation to have on your business over the first six months of 2024?

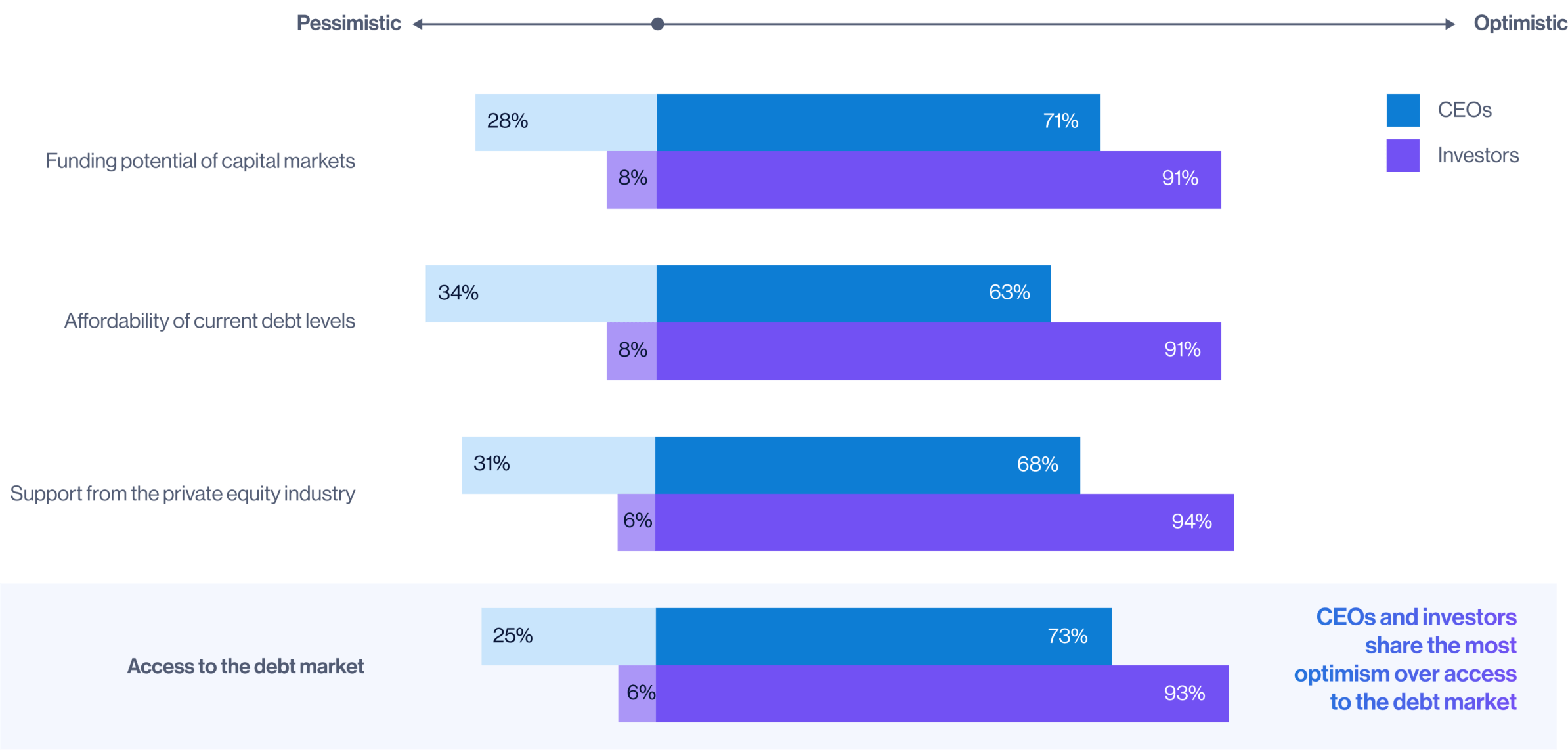

Investors and CEOs share a largely positive outlook on capital markets – including access to debt, capital and private equity funding sources – suggesting that liquidity will continue to remain solid. Given the current interest rate environment, the affordability of debt is, unsurprisingly, a significant pain point for CEOs.

When analyzed by region, CEOs from Asia and Latin America are consistently the most optimistic about capital access going into 2024, while those in Europe and Africa have greater concerns.

Question: Looking ahead to the first six months of 2024, are you generally optimistic about the following?

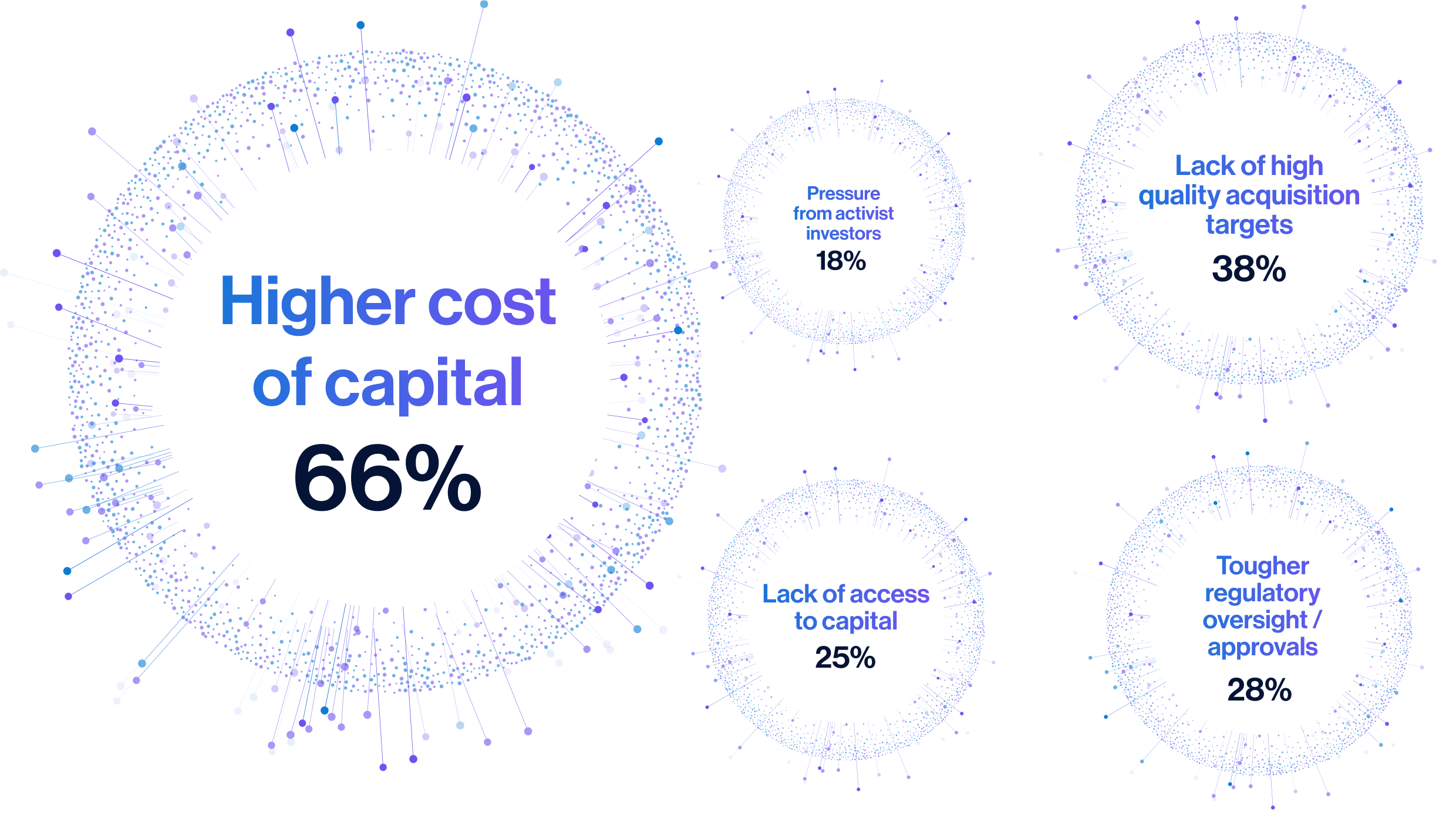

M&A appetite is high among both CEOs and investors, with 68% expecting a highly active M&A market in 2024. Cost of capital is the one key pain point for CEOs, with 66% highlighting the higher cost of capital as the top barrier to M&A activity – far outweighing concerns about a lack of high quality targets (38%) and tougher regulatory oversight (28%).

68% of CEOs and investors expect an increase in M&A activity in 2024

Question: Which, if any, of the following do you consider to be major barriers to M&A in 2024? (select all that apply)

Debate on the future of London’s capital markets has been a central theme of discourse during 2023 – for both the business community (well-articulated by the Capital Markets Industry Taskforce) and the UK government. Reductions in equity holdings by UK pension funds over time is one of the factors being blamed for reduced liquidity in the market. Boards are also concerned about UK corporate governance and stewardship rules, as revealed by the State of Stewardship report in 2022.

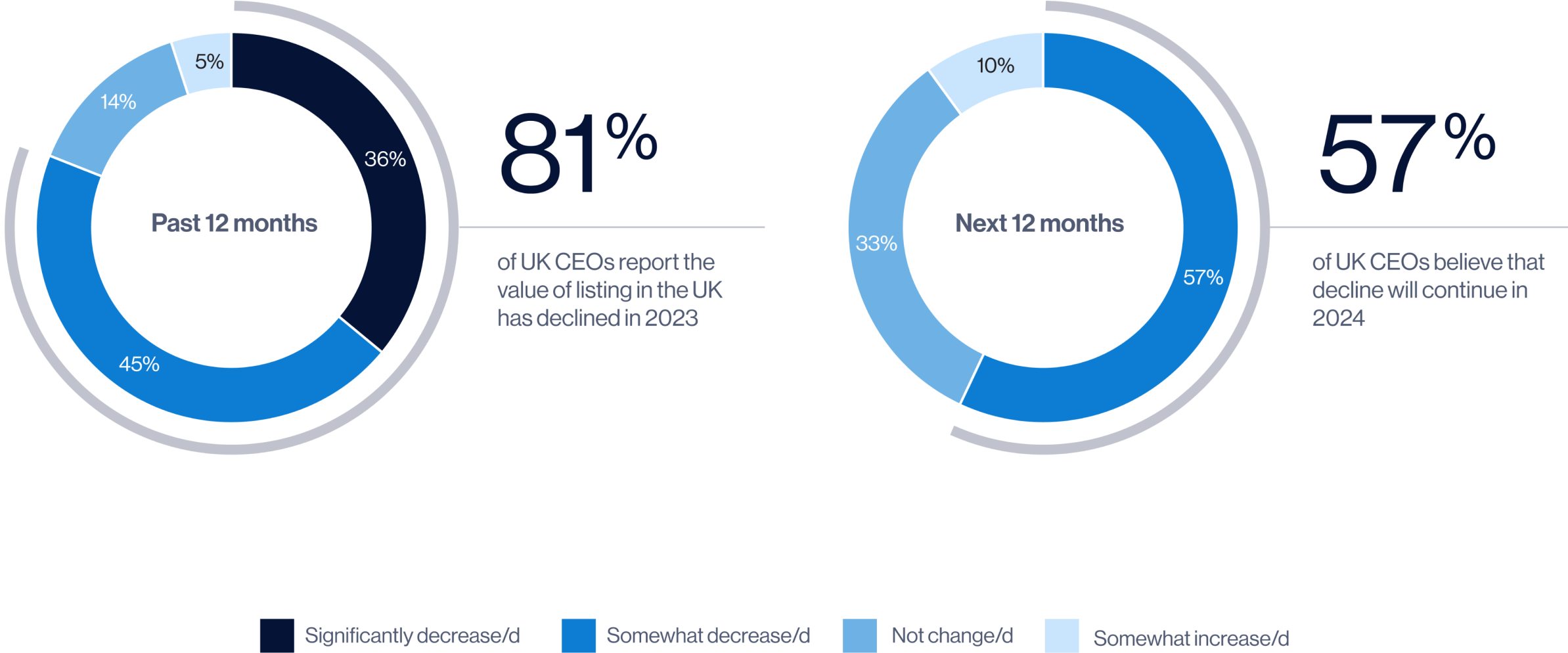

Of the sample of UK CEOs surveyed, 81% say the value of being listed in London has declined over the past 12 months. 57% say they expect that to worsen in the year ahead. Although, to date, few companies have made the decision to change listing venue, roughly one-third of those surveyed say they have considered switching their listing elsewhere.

32% of UK CEOs surveyed have discussed with their board the potential of moving their listing away from the UK market

Question: Thinking about the past / next 12 months, do you feel the value your company gets from being listed in the UK, versus listing in other markets, has / will increase/d or decrease/d?