ESG

Companies can’t ignore the recent politicization of ESG. Survey results indicate that 72% of CEOs polled are making one or more changes in how they operate in response to the shifting environment.

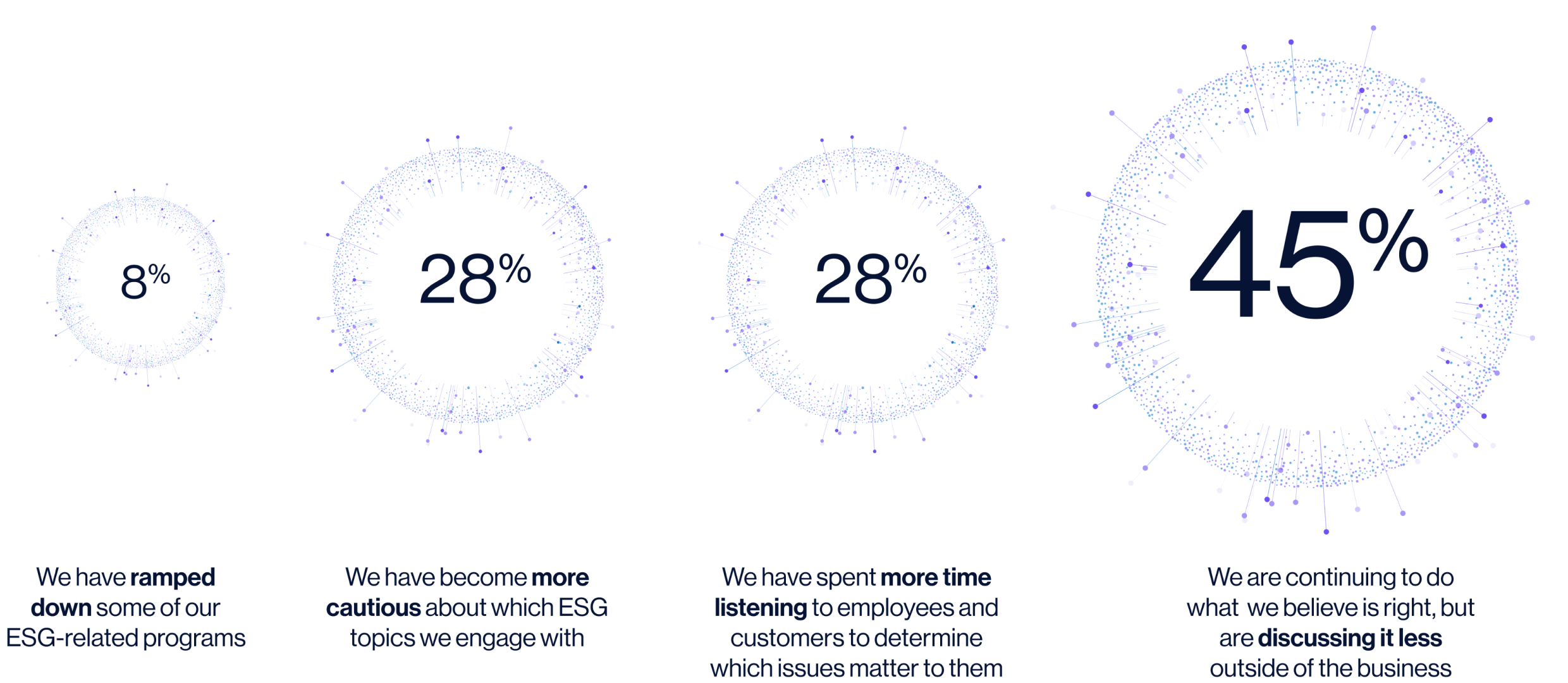

However, whether they choose to be less vocal about their ESG initiatives externally – or even eliminate the acronym from their communications altogether – a vast majority of CEOs continue to believe that certain ESG issues are critical to their business and to their stakeholders. In fact, only a very small percentage of companies (8%) report ramping down some of their ESG-related programs in response to these political headwinds. Those that do so may avoid some short-term backlash, but still face increased scrutiny from stakeholders and forego benefits to the business in the longer-term.

92% of CEOs are standing by their ESG-related programs

Question: How, if at all, has the politicization of ESG affected how your business operates? (select all that apply)

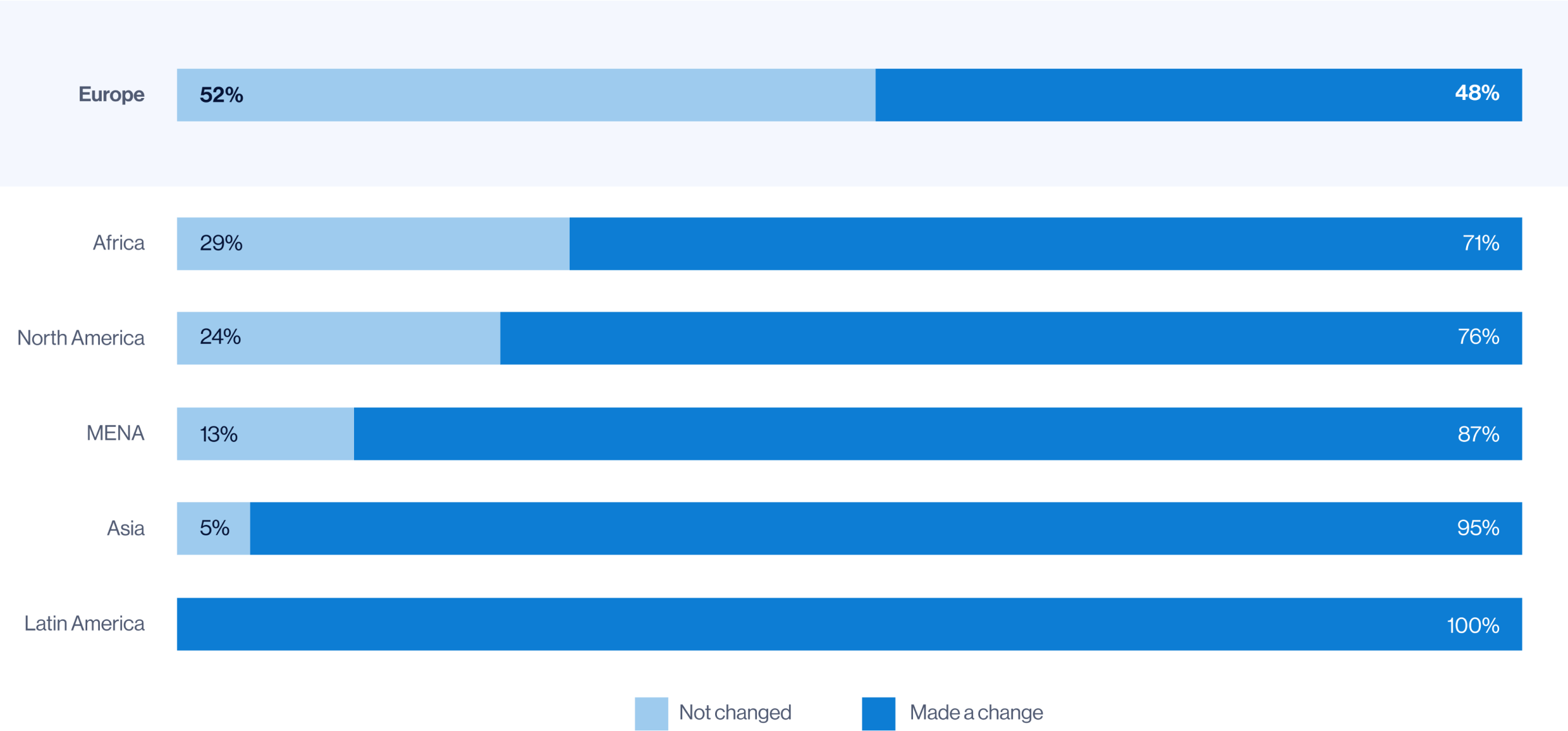

The ESG politics of each region are complex. According to the survey, those regions that are newer to ESG (Latin America, MENA, Africa, Asia) are reprioritizing issues and listening to stakeholders at a higher rate than those regions where ESG initiatives are more established.

Europe is the only region where the majority of CEOs (52%) indicate that the politicization of ESG has not affected how their businesses operate. European CEOs continue to hold fast and indeed lead the rest of the world from an ESG reporting and regulatory perspective. Therefore, leaders of global companies will need to address European requirements and other ESG mandates, regardless of how the political landscape continues to evolve.

Question: How, if at all, has the politicization of ESG affected how your business operates?

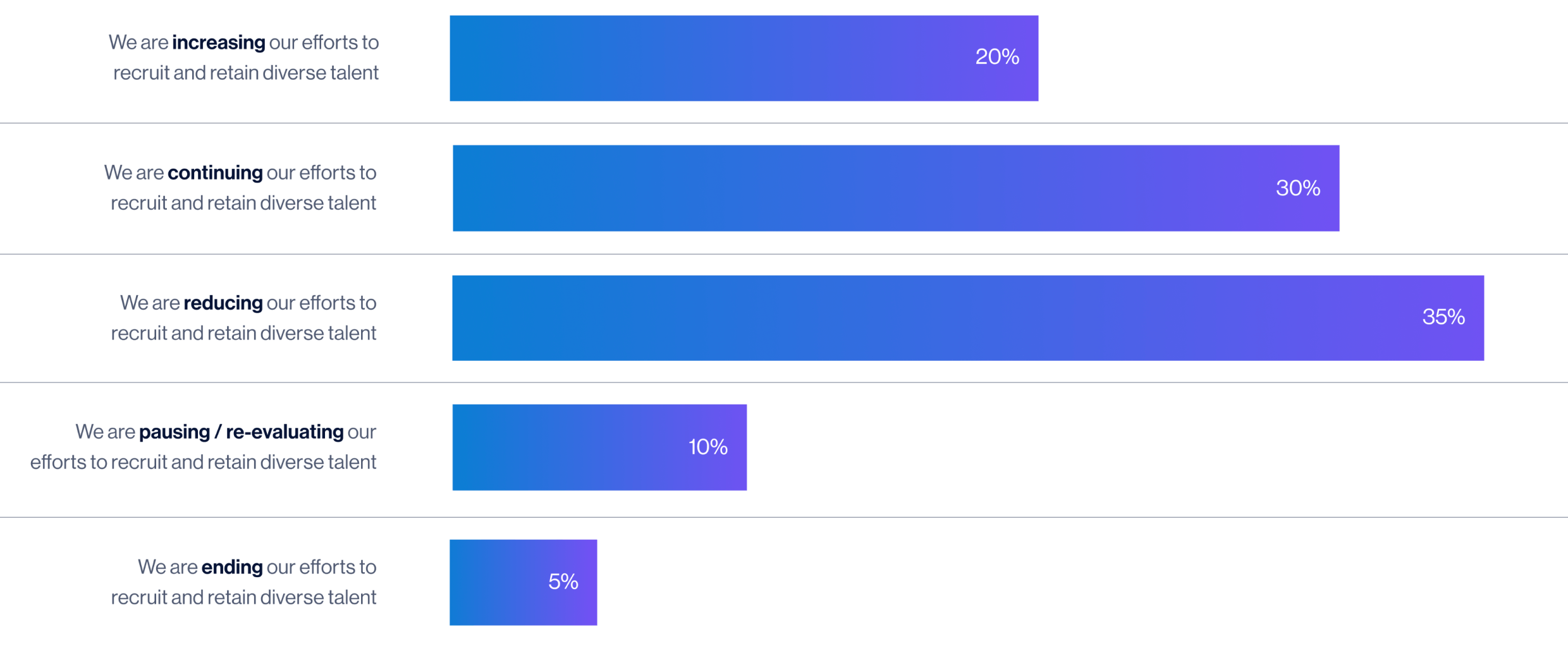

U.S.-based CEOs are divided on DE&I programs: half are continuing or accelerating their programs, 15% are scaling back or ending their programs and over one-third are taking time to re-evaluate.

Companies have had to contend with increased scrutiny regarding their DE&I programs in 2023, as recent regulatory and legislative challenges to topics such as LGBTQ+ rights and affirmative action have invigorated anti-DE&I initiatives/groups.

While there has been no legal change to corporate DE&I rules and regulation, the perceived risk is likely to increase with DE&I on the agenda for the 2024 election. Those pausing or re-evaluating are likely adapting messaging to minimize risk and are cautiously monitoring the environment. It will be critical for companies to include legal perspectives alongside the business risks of slowing down or scaling back their DE&I programs.

Question: How are you thinking about your business’s diversity, equity and inclusion programs?