Innovation

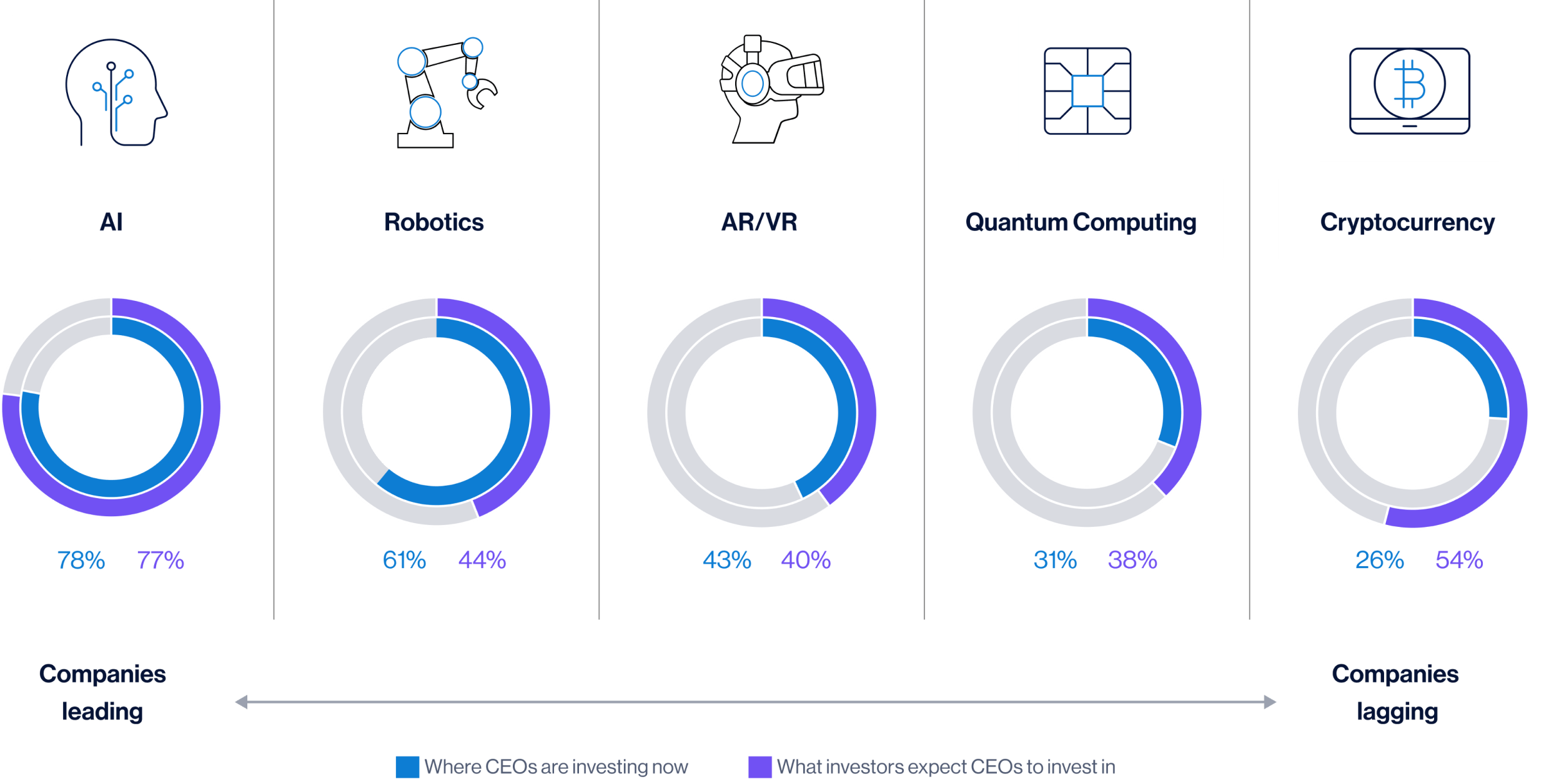

2023 will be marked as the year AI went mainstream and CEOs took notice. Investments in AI are the highest priority for companies’ technology spending, as CEOs look to AI to drive up efficiency and quality while boosting overall performance. The market clearly supports that strategy. According to the survey, AI is the only technology vertical where corporate leaders and investors are perfectly aligned on technology investment levels.

Although technology investment priorities in other areas are also generally well-aligned, a notable exception is investment in crypto. With anticipated interest rate cuts and the potential approval of listed Bitcoin funds pushing the price of cryptocurrencies to a high point for the year, investors are far more optimistic than CEOs on a resurgence of cryptocurrency.

Question: Which of the following technologies is your company actively investing in? (select all that apply)

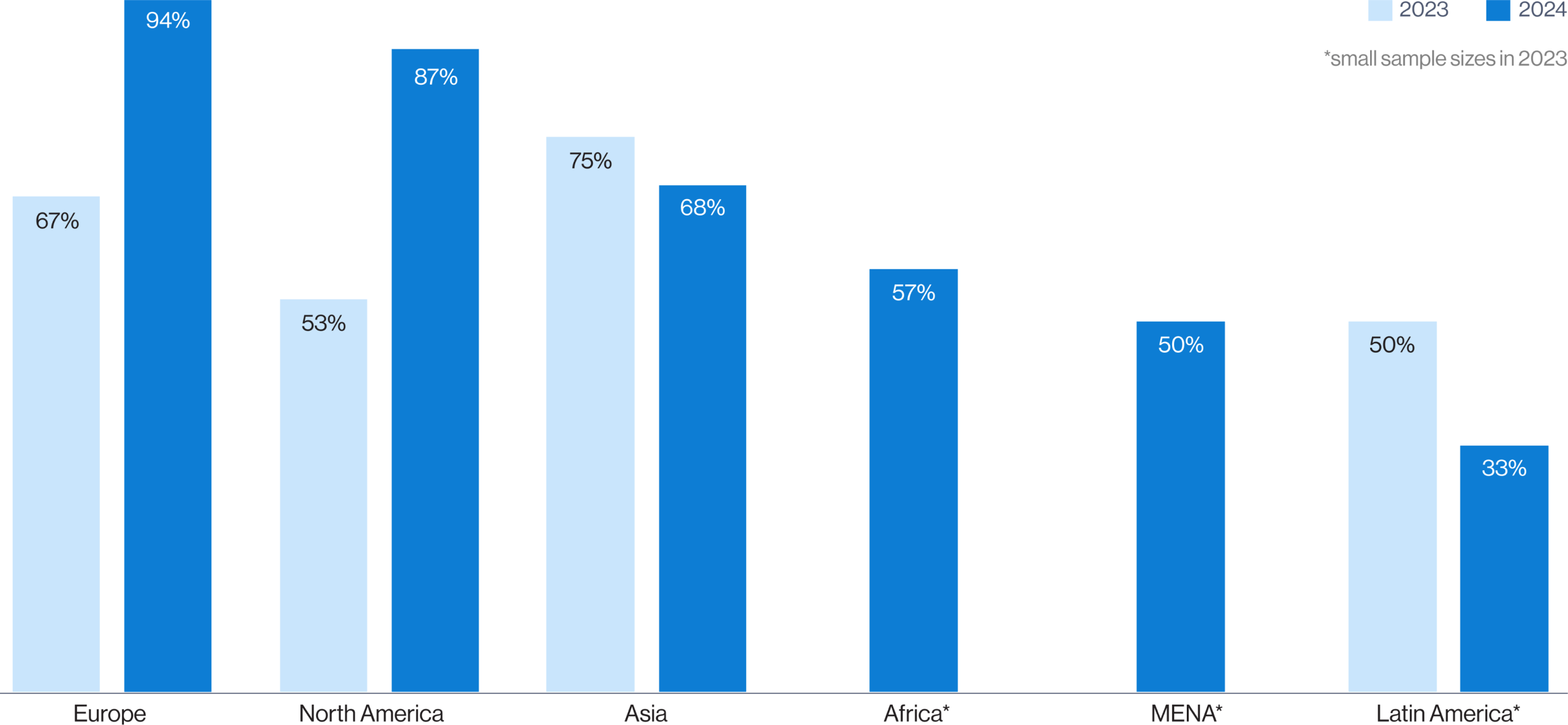

With the explosion of new AI technologies, 78% of CEOs are investing in AI – a 20-point jump from last year. However, analysis of responses by region reveals significant risk of potentially uneven development of the technology worldwide.

Given the global race for AI talent and high costs and export restrictions tied to critical AI hardware, companies in developing economies are significantly (up to 61 points) less likely to be investing in AI. The resulting digital divide could leave developing economies behind and institutionalize biases in the development of new AI-powered capabilities.

78% of CEOs are investing in AI, a 20-point jump from 2023

Question: Which of the following technologies is your company actively investing? (select all that apply)

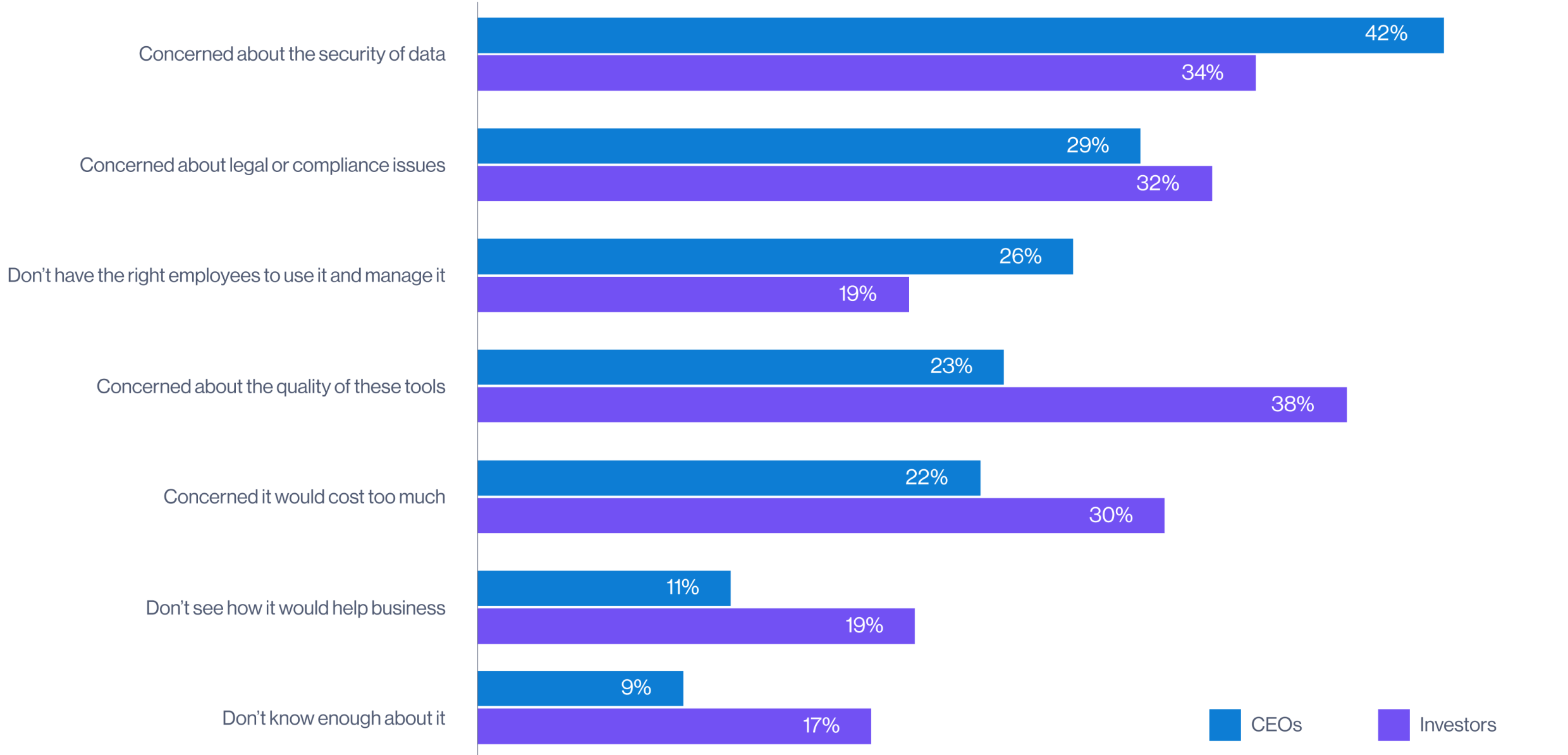

For CEOs, data security, compliance and qualified talent are the most significant factors preventing faster AI adoption. Investors, however, believe that the quality of AI tools and implementation costs are the greatest barriers to adoption.

Earlier this year, Stanford University found an increase in U.S. job postings across sectors and job types that listed AI fluency as an essential skill. More recently, the Biden administration’s Executive Order on AI made changes in immigration rules to widen access for foreign workers with essential AI abilities. It is clear that those businesses that crack the code on AI talent will be well-positioned for success in the coming years.

1 in 4 CEOs do not believe that they have the right people to power their adoption of AI

Question: What is the biggest barrier to your business / leading corporations adopting AI? (select all that apply)

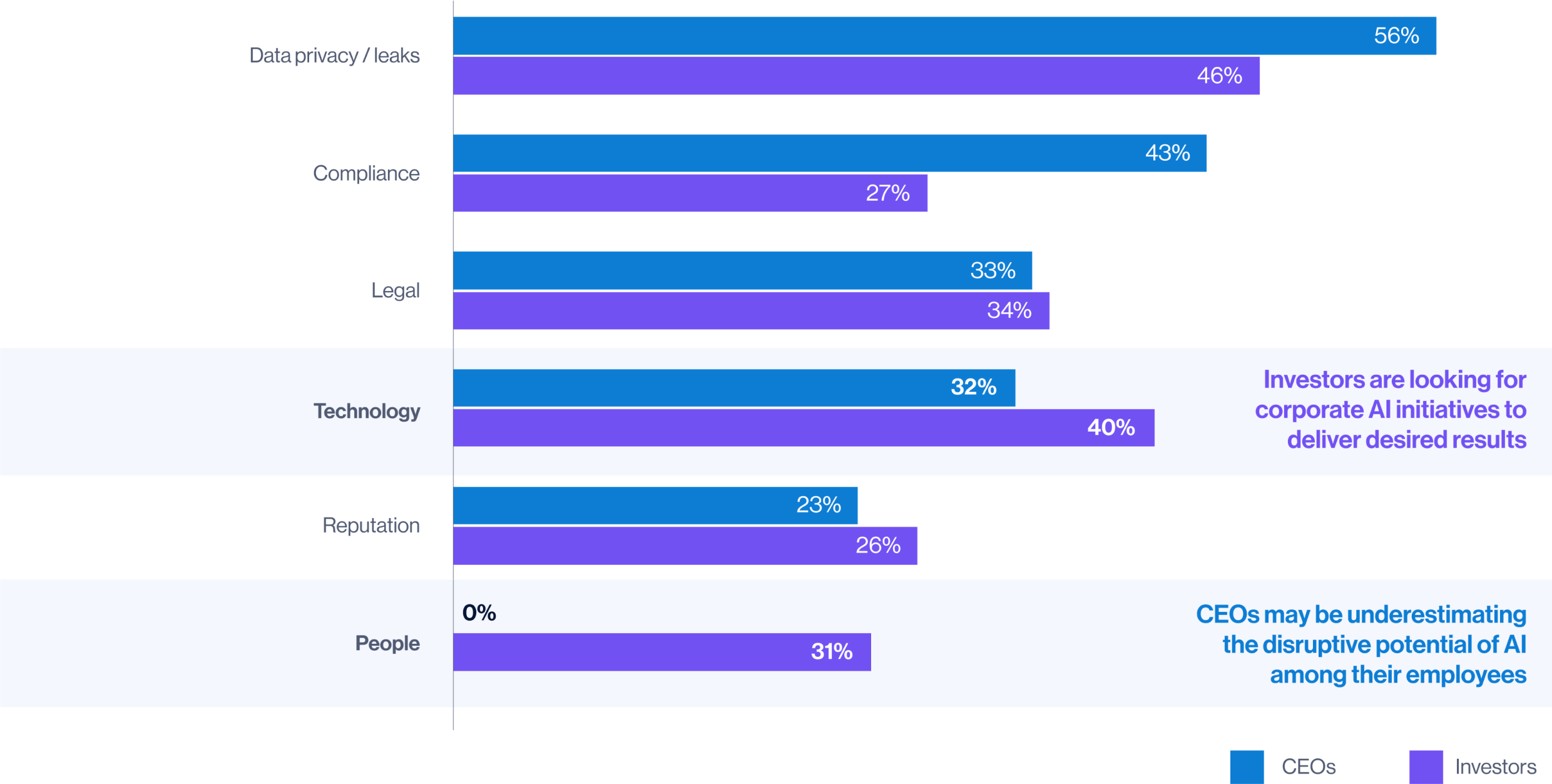

To be sure, CEOs are focused on privacy and compliance risks implicit in the use of AI, while some 40% of investors are primarily looking for tangible results – particularly given the associated costs of implementation.

Notably, virtually no CEOs cite people risks (e.g., employees refusing to work with the technology, turnover, reskilling/training issues) as an area of concern, compared to 31% of investors. This disconnect suggests that CEOs may be drastically underestimating the potential for disruption within their own ranks. Given the pressure to hire employees with AI fluency (see Figure 12), businesses must also develop comprehensive reskilling and upskilling programs to boost AI literacy among their workforce – or risk attrition among those who worry AI will come for their jobs.

Question: What do you see as the biggest risks to your business / leading corporations of using AI? (select all that apply)