Welcome to this edition of the Weekly Political Compass from Teneo’s political risk advisory team!

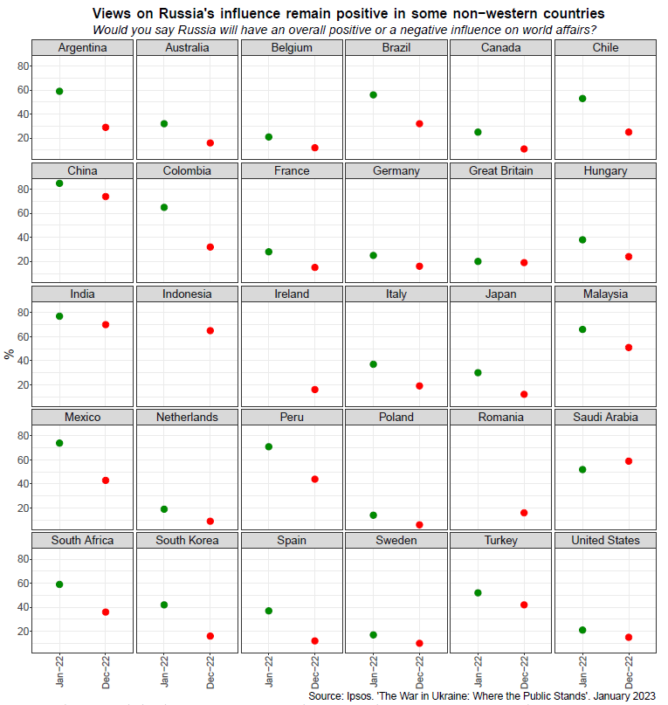

This week, we are taking a closer look at Russia. Meanwhile, Thailand is preparing for elections, the anniversary of the Ukraine invasion looms, and South Africa’s annual budget will be presented. Our graph of the week zooms in on global views of Moscow's role in international politics.

Global Snapshot

Russian President Vladimir Putin addressed the Federation Council (upper chamber of parliament) on 21 February. Our CEE advisor Andrius Tursa answers three key questions.

What was Putin’s main message?

As on multiple occasions in the past, Putin blamed “Western elites” for starting and perpetrating the war in Ukraine and for aiming to “inflict strategic defeat on Russia”. According to Putin, Russia will respond to such threats.

What are the implications on the international stage?

Putin announced that he would suspend observation of the New START nuclear weapons treaty. He also committed to continued implementation of the objectives of the “special military operation” in Ukraine.

What are the next domestic political events to watch?

Putin promised to hold the 2023 regional elections and the 2024 presidential elections on schedule. This implies that the country-wide martial law or the state of war will not be introduced at that time.

What to Watch

ASIA PACIFIC

Japan

Academic economist Kazuo Ueda’s journey towards becoming the next Bank of Japan governor begins in earnest this week. A Lower House nomination committee hearing on 24 February will be followed by a similar hearing at the Upper House and plenary approval votes in both chambers. Ueda was known as a theoretician and a cautious dove when a monetary policy board member in 1998-2005, while latterly he has highlighted the need for an exit strategy from the Bank’s decade-old ultra-loose policy framework.

Thailand

Prime Minister Prayuth Chan-ocha said today that he expects to dissolve parliament in March, with elections possibly on 7 May as tentatively set by the election commission (EC). The EC is currently setting the boundaries of electoral districts, which is required every election, and it is expected to complete the process by the end of February or in early March. Prayuth has transferred to a new party, and likely wants to push the election schedule to the limit to allow him more time to campaign.

US/China

Without explicitly mentioning the US, Chinese Foreign Minister Qin Gang said on 21 February that China “urges certain countries to immediately stop fuelling the firein Ukraine.” Qin’s comments came two days after US Secretary of State Anthony Blinken warned of “consequences” if Beijing supplies weapons for Russia’s war in Ukraine.

EUROPE

Russia/Ukraine

This week marks the one-year anniversary of Russia’s invasion of Ukraine. Following a surprise visit to Kyiv on 20 February, US President Joe Biden is now in Warsaw, where he will hold a series of meetings with political leaders from Central and Eastern Europe (CEE) to reassure NATO allies of Washington’s continued commitment to the region. Biden is set to deliver an address in the afternoon of 21 February. Ahead of 24 February, both the US and the EU are planning a new package of sanctions on Russia. Meanwhile, Ukrainian authorities are bracing for a potential Russian air attack on 23-24 February.

MIDDLE EAST AND AFRICA

Nigeria

General elections will kick off this week with the presidential poll scheduled for 25 February. With several polls showing a likely win for Labour Party (LP)’s Peter Obi, his base has been incredibly galvanized ahead of the polls. Yet, given how unreliable polling is in Nigeria, his victory if far from assured, and indeed, there remains a high likelihood of a run-off.

South Africa

On 22 February, Finance Minister Enoch Godongwana will present South Africa’s annual budget. Godongwana must walk a tightrope act of showing that he is sticking to his medium-term fiscal targets, while accommodating lower growth and higher spending pressures. Under scrutiny will likely be fiscal deficit and growth projections; public enterprises (particularly power utility Eskom); as well as the public-sector wage bill. Efforts to stabilize power supply will take center stage, given Eskom’s crippling effect on the economy and Godongwana’s pledge that he will finally announce a debt solution. The budget is expected to be followed by a cabinet reshuffle that will be scrutinized for President Cyril Ramaphosa’s inclination to speed up reforms.

Graph of the Week

One year after Russia started its invasion of Ukraine, citizens across the globe remain divided on the role Moscow will play in world affairs moving forward. While in most countries people have turned more negative towards Russia, there is still important variation. Western countries are the most pessimistic about Russia’s actions in the future; even in countries like Italy, where political elites were less critical of Russia before the war, citizens have become very negative. Opinions of Russia have also deteriorated substantially in some Latin American countries, such as Argentina, Brazil, or Colombia, but the public mood remains more positive than in rich democracies. This perception is even more pronounced in nondemocratic countries such as China and Saudi Arabia, where survey data is likely to reflect the views of domestic elites.