Private capital firms require access to dedicated value creation capability and integrated strategies to reach critical size and recognition.

Evidence shows that having such capabilities and strategies not only enhances performance, but also assists funds in articulating how and where they add value over and above pure capital allocation and financial engineering. This will become increasingly important moving forward as investors require more transparency in non-financial data, such as ESG, and is therefore fundamental to growth and justifying fees.

Overview

Private equity (PE) has enjoyed tremendous success during its first five decades by adopting the mantra ‘buy well, sell well and do everything in-between’ and successfully evolving its approach. The approach to value creation and its level of sophistication has evolved over time with operational value creation more recently becoming the main driver of PE returns in developed markets. However, the stage of evolution in Asia is less conclusive. Whilst approaches to value creation are evolving in Asia, the drivers are more varied, which mirror Asia’s highly fragmented and heterogeneous market. There is also a broader spectrum of sophistication between the approaches adopted by the leading investment firms and the rest. Consequently, we will continue to see a bifurcation of investment strategies and relative success, which will likely only be exacerbated by any economic downturn.

The evolution of value creation witnessed in PE will also likely start to be observed amongst the rapidly emerging private credit funds.

In this article, we explore the maturity of value creation in the Asian investment market and its impact on performance. We also ask funds if they can articulate how and where they add value.

Key Takeaways:

- There is a broadly positive relationship between fund success (as measured by IRR and size of funds raised) and the level of an investment firm’s value creation maturity.

- A bifurcation is observed based on investment strategy and size of capital raised, with those firms in the middle tending to show the weakest performance.

- Mid-sized PE funds show the greatest need to have access to dedicated value creation approaches to achieve critical size and success.

- Investment firms’ approaches to value creation vary greatly and evolve over time. Consequently, having an investment model that relies mainly on co-investment ability or using external consultants on a transactional basis is arguably sub-optimal to sustained performance and limiting to growth.

- The evolution of value creation observed in PE will likely also occur for private credit funds. This evolution will only be accelerated in any market downturn.

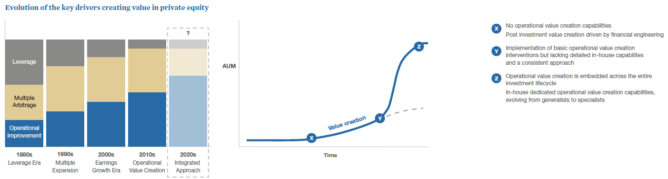

Evolution of Value Creation

Value creation is often simplistically perceived as improving performance or creating investment returns over a chosen benchmark. But this is only partly true and may only reflect the extrinsic elements of ‘buying and selling well’ and not necessarily the intrinsic efforts to ‘do everything in-between’.

Over the years, PE has seen a significant evolution in how it creates value, steadily moving from financial engineering, through operational improvement to an ever-evolving approach of integrated investment and operational levers (including non-financial levers and ESG). Therefore, whilst this admittedly provides a highly-simplified meaning of ‘value creation’, for the purposes of this article we are essentially referring to any deliberate activity over and above purely allocating investment capital or financial engineering that contributes to improved financial performance.

From our assessment and interviews, it was clear that the leading global funds systematically implement value creation strategies. They have highly sophisticated processes, see value creation as their core purpose and fully integrate it as part of their culture and DNA.

- They leverage their scale, dedicated teams and infrastructure to maximise value across the entire investment lifecycle.

- They systematically incorporate value creation strategies in pre-deal due diligence and investment decisions and align management incentive plans to execute against these.

- They deliver a suite of value creation interventions both within individual portfolio companies and at the fund level and adopt a continuous feedback-loop and iterative approach to improve their overall approach to value creation.

Unsurprisingly, this relentless focus on improvement and value creation is reflected in their ability to continually out-perform other asset classes in terms of performance and capital raised. It was also interesting to note from our interviews that those funds that did have dedicated value creation capability, and that were able to effectively articulate their formalised processes, believed they were also in a better position to explain to investors their higher cost base and to justify management fees.

Mid-Size Firms Show Greatest Need

Many smaller and mid-sized funds that lack dedicated operational capability reported an inconsistent approach to value creation and were less clear on their investment differentiation. Within these funds, we also observed the need for co-investment with other funds or investors, thereby reducing their standalone ability to drive strategy and growth. In these instances, many are still relying on more traditional approaches such as financial engineering, allocating capital to companies in high growth sectors or relying on investment partners.

Our interviews reflected the differences in approach between the large funds with in-house value creation teams and clearly articulated explanations of how and where they added value, versus the mid-sized and smaller funds that had a less defined value proposition.

This observation was also reinforced by assessing the absolute number and relative success of new funds. For example, despite Covid, there has been a sharp increase in new fund registrations, up 119% between 2018 and 20202. This reflects both the growing popularity of PE and the favourable regulatory and tax landscape in Hong Kong. However, many new funds struggle to progress to the next stage of development, with over 20% failing to raise another fund within five years. This split in success is reinforced by fund size for those that were able to raise 3 or more funds.

Key Takeaways

- Many firms are only able to raise one or two funds, both being sub-US$500m in size.

- Those firms that make the step beyond this initial phase, can also do so with increasing size.

- These points reiterate the dispersion between the amount of new funds launched and those firms that break through to achieve critical size and institutional funding.

Asia is Different

In terms of growth, Asia has mirrored the global private capital industry with AUM reaching a record US$1.71tn as of September 2020, up 2.8x in only five years. This acceleration makes it the world’s fastest growing market with the growth forecast to continue at a CAGR of 28.3% between 2020 and 2025 to reach US$6.1tn.

This growth (both in terms of number of funds and AUM) has not, however, consistently translated into stronger returns when compared to developed markets. This likely reflects Asia’s more complex market and investing landscape, specifically the predominance of minority stake investments, SMEs and family-owned businesses, as well as the heterogeneous regulatory, geographical and cultural jurisdictions.

These factors, in addition to some funds’ reliance on underlying growth, reduce the direct ability of funds to drive value creation strategies. This is less important in a growing market, but when considering economic cyclicality, it highlights the broad range of sophistication between the leading investment firms and the rest.

A Differentiator in a Downturn

As the world emerges from Covid, and analysts begin to consider the economic outlook with record debt, forecast inflation and an increasing yield curve, the focus of capital allocation is likely to shift towards value sectors and more balanced portfolios.

Therefore, after a period of relatively benign investment conditions, it would be prudent for investment firms to consider the impact of an economic downturn. Historical data suggests that in such a downturn, there is a 30% difference in performance between funds with and without value creation teams, with the benefit being more marginal in a growing market. Coupled with lower Covid-related fiscal stimulus packages across Asian countries and territories, and the fact that the average time-lag of the peak of non-performing loans is 3.3 years, this would indicate that having a dedicated value creation capability will become increasingly relevant across the Asian market.

Emergence of Value Creation in Private Credit Funds

The leading Asian private credit funds have achieved rapid success over the last decade with AUM growing 181% since 2016, standing at US$59bn as of September 20209, as they increasingly bridge the US$4tn funding shortfall from traditional bank lending. Therefore, as PE has witnessed both an evolution in value creation drivers and an increase in the sophistication of such drivers, it seems logical that, in an increasingly competitive market, the leading private credit funds will also start to embrace active value creation strategies in their next stage of development.

This theme was reiterated by our interviews, in which we witnessed private credit fund managers exploring a more active approach to managing their investments, for example by appointing board observers or directors and having veto rights over certain commercial decisions. Whilst, at face value, each of these measures appear to be driven by a more equity-like investment strategy, they are mainly used to increase downside protection. However, as private credit funds begin to explore levers of influence on investee companies to manage downside risk rather than solely relying on heavily collateralised loan-to-value security, we believe that the next step on their evolutionary ladder will be to develop ways of enhancing, rather than purely protecting, value. There are, of course, some difficulties in approaching credit investing in this way, especially resistance from investee companies who do not want increased interference. However, private credit funds that choose to embrace a hybrid debtequity model from both an investment and operational perspective can distinguish themselves as both a lender and investor of choice. They will be able to capture more upside and identify and act upon evidence of stress at an earlier stage by being closer to an investee company’s operations and governance.

Key Takeaways:

- Greater monitoring and adherence to a business plan will assist in keeping an investee company on its planned growth strategy.

- Driving operational performance will give an enhanced ability to take advantage of equity kickers and increasing value of investments.

- Reviewing performance with reference to financial covenants raises the risk of identifying stress or distress after it has occurred.

- Reviewing performance against a business plan increases the likelihood of identifying, and acting upon, operational and market headwinds.

- Driving operational performance KPIs will reduce the need for enforcement actions and value dilution through distressed sales.

- Avoiding enforcement actions saves management time and external costs.

- Value creation plans are even more important when funds are deploying a loan-to-own strategy.